Singapore, Feb. 11, 2026 (GLOBE NEWSWIRE) -- ELLIPAL and PAYDAO today announced the launch of ELLIPAL Pay × PAYDAO, a self-custodial, on-chain Point-of-Sale (POS) payment ecosystem that enables native stablecoin payments at physical merchant locations.

The launch introduces a fundamentally new payment architecture in which authorization, settlement, and custody are no longer bundled within banks, card networks, or centralized intermediaries, but instead executed directly through cryptographic ownership and a decentralized payment protocol.

Why This Architecture Changes the Payment Equation

Most crypto payment solutions today follow a hybrid model.

Digital assets may be held on-chain, but transactions are ultimately routed through traditional card networks and settled in fiat currencies such as USD.

While these approaches improve accessibility, they leave the underlying payment stack unchanged.

ELLIPAL Pay × PAYDAO takes a different path.

Each transaction is:

- Authorized locally on a self-custodial NFC payment card

- Signed offline, with private keys never leaving the user’s device

- Settled natively on-chain through a decentralized payment protocol, directly in stablecoins

There is no issuing bank, no acquiring bank, no card network, and no custodial account involved at any stage of the transaction.

In this model, crypto does not adapt to legacy infrastructure — it operates as the infrastructure itself.

A Practical Step Toward On-Chain Commerce

Global card payments exceed $40 trillion annually, yet merchants continue to face high fees, delayed settlement, and chargeback exposure.

Stablecoins have already demonstrated price stability and global liquidity.

What has remained unresolved is how those assets are executed and settled at the point of physical purchase.

ELLIPAL Pay × PAYDAO addresses this gap by enabling sub-1% transaction fees, real-time on-chain settlement, and irreversible settlement — a payment flow designed for efficiency, certainty, and asset sovereignty.

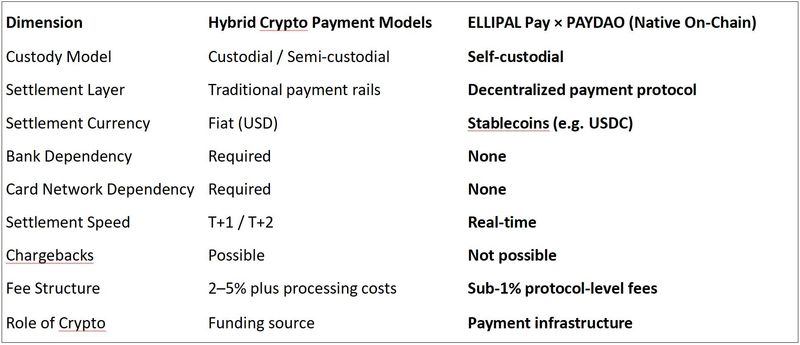

Native Payments vs Hybrid Models

The difference between hybrid crypto payment models and native on-chain payments becomes clear at the architectural level:

Designed to Scale Without Centralized Control

The ecosystem also introduces a decentralized deployment model.

Through the ELLIPAL Pay Business Kit, POS terminals can be deployed by independent participants, with rewards distributed according to real transaction activity. Users are similarly incentivized through usage.

This approach allows payment infrastructure to expand without centralized balance sheets or subsidy-driven growth, while remaining anchored in real economic activity.

Looking Ahead-

The ELLIPAL Pay × PAYDAO ecosystem is currently operating in a validation phase with single-chain support. Multi-chain EVM integration is planned for 2026, followed by broader merchant adoption in 2027.

As stablecoins continue to move from financial instruments toward everyday utility, payment systems that are native to the blockchain — rather than dependent on legacy rails — are expected to play an increasingly central role in global commerce.

About ELLIPAL

ELLIPAL is a provider of air-gapped, self-custody hardware wallet solutions supporting over 10,000 digital assets across nearly 50 blockchains. Founded in 2018, ELLIPAL serves users in more than 100 countries with products designed to keep private keys permanently isolated from online threats. Learn more.

About PAYDAO

PAYDAO is a decentralized stablecoin payment protocol focused on enabling native, on-chain commerce in physical merchant environments. Its ecosystem includes crypto POS terminals, decentralized payment settlement infrastructure, and a community-driven incentive model governed through DAO mechanisms. Read more.

Media Contact

Company Name: ELLIPAL LIMITED

Contact: Grace Chen

Email: business@ellipal.com

Website: https://www.ellipal.com/

Company Name: PAYDAO

Email: info@paydao.io

Website: https://www.paydao.io/#top

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Grace Chen ELLIPAL LIMITED business (at) ellipal.com