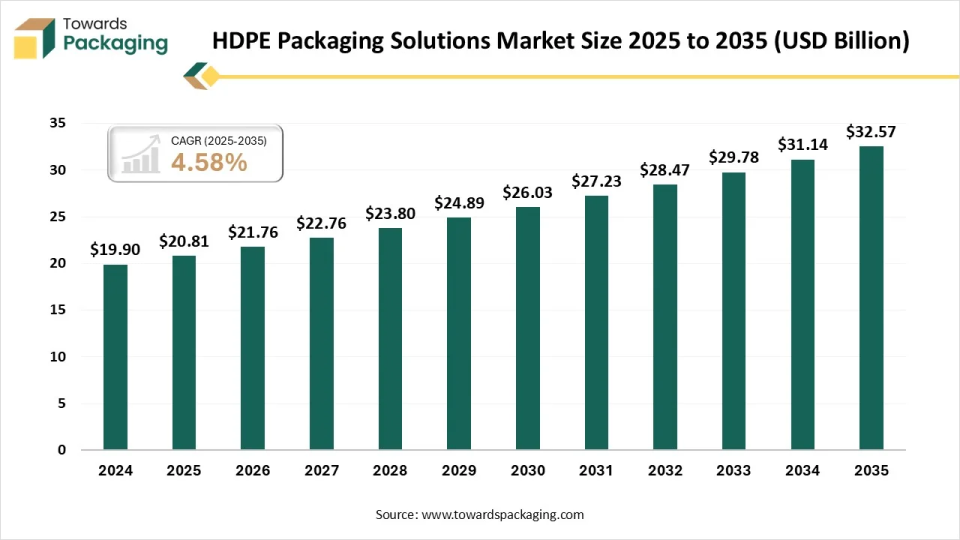

Ottawa, Feb. 11, 2026 (GLOBE NEWSWIRE) -- The global HDPE packaging solutions market reported a value of USD 20.81 billion in 2025, and according to estimates, it will reach USD 32.57 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by HDPE Packaging Solutions?

HDPE (High-Density Polyethylene) packaging solutions refer to the use of a strong, rigid, and versatile thermoplastic material to create durable containers, bags, and protective materials. Characterized by high density and chemical resistance, these solutions are used for transporting and storing goods across industries due to their lightweight, cost-effective, and recyclable nature.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5941

Private Industry Investments for HDPE Packaging Solutions

- Berlin Packaging Acquisition of Alpack Ltd.: This 2024 deal focused on expanding manufacturing capabilities for HDPE bottles tailored specifically for the pharmaceutical and food sectors.

- Silgan Holdings Acquisition of Weener Plastics: Completed in late 2024, this investment aimed to scale global production of differentiated HDPE dispensing solutions for personal care and healthcare.

- ALPLA’s Acquisition of Heinlein Plastik-Technik: This strategic move strengthened the company’s portfolio of HDPE closures and dosing systems specifically for medical packaging applications.

- LyondellBasell’s Recycling Plant Joint Venture: This 2025 investment involves acquiring a 50% stake in a German facility to scale the production of high-quality recycled HDPE for circular packaging.

- Private Equity Buyout of a Top-Tier HDPE Supplier: A major $400 million acquisition by a U.S. firm was recently finalized to capitalize on the market's rapid shift toward recyclable rigid plastic formats.

What Are the Latest Key Trends in the HDPE Packaging Solutions Market?

- Post-Consumer Recycled (PCR) HDPE: High demand for recycled, food-grade HDPE is driving manufacturers to incorporate PCR materials to meet regulatory requirements and corporate sustainability goals.

- Smart Packaging and AI: Adoption of AI-driven defect detection in manufacturing and the integration of IoT for smarter, more traceable containers.

- Advanced Barrier Properties: Development of multi-layered, antimicrobial HDPE films and bottles to enhance shelf-life in food, beverage, and pharmaceutical applications.

What is the Potential Growth Rate of the HDPE Packaging Solutions Industry?

The HDPE packaging solutions industry is driven by the rising demand for sustainable, lightweight, and durable materials across industries like food, pharma, and personal care. The Key growth drivers that support the growth and expansion of the market include the urgent shift toward circular economy models, increased recycling capabilities, and rapid e-commerce expansion.

Regional Analysis:

Who is the leader in the HDPE Packaging Solutions Market?

Asia Pacific dominated the global market by 45.5% share in 2025, due to rapid industrialization, strong manufacturing sectors, and high adoption of automation. The market is poised for continued, steady growth, with a focus on integrating post-consumer recycled (PCR) content. Other key growth factors that support expansion in the region are Rapid urbanization, the need for sustainable, recyclable, and cost-effective packaging, and the rise of e-commerce.

India HDPE Packaging Solutions Market Growth Trends

The Indian market is experiencing robust growth, driven by rising demand in FMCG, personal care, and industrial applications. Key drivers include the need for durable, lightweight, and cost-effective packaging, which further supports the growth and expansion of the market in the country. The other major factor is the shift towards sustainability and recyclability, which drives growth.

How is North America expected to grow in the HDPE Packaging Solutions Market?

North America is expected to grow at the fastest rate in the market, driven by robust demand for rigid containers, food packaging, and sustainable, recycled-content solutions. Growth is fueled by e-commerce, urbanization, and advancements in lightweighting. High demand from food & beverage, pharmaceutical, and industrial sectors for rigid, chemical-resistant packaging further propels the growth.

US HDPE Packaging Solutions Market Trends

The US market is growing, driven by demand for sustainable, lightweight, and durable solutions, with the market for containers expected to rise significantly, supporting the growth. The key growth factors that further push the growth are increasing adoption of post-consumer recycled (PCR) HDPE, growth in e-commerce, and demand from the pharmaceutical and food/beverage sectors

More Insights of Towards Packaging:

- Automotive Parts Packaging Market Size, Trends, Share and Innovations

- North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Black Rigid Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Refillable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Dairy Product Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

Segment Outlook

Product Type Insight

How did Bottles Segment Dominate the HDPE Packaging Solutions Market?

The bottles segment dominated the market, accounting for 35.6% of the market in 2025, due to their durability, chemical resistance, and lightweight nature, making them ideal for packaging liquids, semi-liquids, and household chemicals. Increasing demand for recyclable and cost-effective packaging solutions, along with growth in the FMCG and healthcare industries, continues to drive strong adoption of HDPE bottles across global markets.

The film segment is projected to grow at the fastest rate in the market in the forecast period, due to its strength-to-density ratio, moisture resistance, and processing versatility. These films serve in industrial applications. Rising demand for lightweight packaging, improved shelf life, and sustainable material options is supporting growth. Advancements in film extrusion technologies and increasing incorporation of recycled content are also enhancing the performance and environmental profile of HDPE films.

End-Use Industry Insight

Which End Use Industry Segment Dominates the HDPE Packaging Solutions Market?

The food & beverages segment dominated the market, accounting for 38.7% of the market in 2025, due to the material’s food safety compliance, moisture resistance, and ability to protect product integrity. Growth in packaged food consumption, urbanization, and demand for extended shelf life are fueling adoption. The shift toward recyclable and lightweight packaging further strengthens HDPE’s position in this segment.

The pharmaceutical segment is projected to grow at the fastest rate in the market in the forecast period, because of its chemical inertness, durability, and ability to maintain product stability. It is commonly used for medicine bottles, tablet containers, and healthcare product packaging. Expanding global healthcare access, rising drug production, and growing over-the-counter medication consumption are key factors supporting segment growth.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Material Insight

How did Virgin HDPE Segment Dominate the HDPE Packaging Solutions Market?

The virgin HDPE segment dominated the market, accounting for 63.4% of the market in 2025, due to its high purity, superior mechanical strength, and consistent performance. It is widely used in pharmaceutical and food packaging, where regulatory compliance and material reliability are critical. However, sustainability pressures are encouraging manufacturers to balance virgin usage with recycled content, especially in regions with stringent environmental policies.

The recycled HDPE segment is projected to grow at the fastest rate in the market in the forecast period, as it is gaining strong traction as industries focus on circular economy goals and reducing plastic waste. Technological advancements in recycling processes are improving material quality and performance, enabling broader applications. Government regulations promoting recycled content and corporate sustainability commitments are key drivers accelerating the adoption of recycled HDPE in packaging.

Technology Insight

Which Technology Segment Dominates the HDPE Packaging Solutions Market?

The blow molding segment dominated the market, accounting for 42.4% of the market in 2025, due to its efficiency in producing lightweight, durable packaging with complex shapes. Continuous improvements in automation and energy efficiency enhance production scalability. The method also supports the use of recycled materials, aligning with sustainability initiatives across the packaging industry.

The injection molding segment is projected to grow at the fastest rate in the market in the forecast period, as it is used to produce caps, closures, and rigid packaging components from HDPE. Growth in pharmaceutical, food, and personal care packaging is driving demand for injection-molded HDPE components. Advancements in mold design, multi-cavity systems, and material formulations are improving efficiency and enabling the production of high-performance packaging parts.

Recent Breakthroughs in the HDPE Packaging Solutions Industry

In December 2025, ALPLA received a €5.8 million grant from the European Commission to establish a food-grade HDPE recycling plant in the Netherlands. In partnership with the National Test Centre Circular Plastics, the plant will use solvent-based technology to process 15,000 tonnes of post-consumer HDPE annually into high-quality resin suitable for food-contact applications

in October 2025, Amcor has introduced several high-density polyethylene (HDPE) and polyethylene-based packaging solutions for the healthcare industry as part of its goal to make all packaging recyclable or reusable. These offerings include the AmSky™ Blister System, recycle-ready medical laminates, AmSecure™ thermoformed solutions, and high-shield medical laminates.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the HDPE Packaging Solutions Market & Their Offerings:

Tier 1:

- Plastipak Holdings, Inc. manufactures rigid HDPE containers and preforms using advanced multi-layer barrier technologies for global food and beverage brands.

- Sonoco Products Company produces custom-engineered HDPE components, industrial reels, and protective packaging for heavy-duty manufacturing and consumer applications.

- Sealed Air Corporation provides HDPE-based specialty films and high-density foams designed for high-performance protection in the medical and food sectors.

- Mondi Group offers recyclable mono-material HDPE pouches and moisture-resistant industrial bags for home care and chemical industries.

- Huhtamaki Oyj develops high-barrier flexible laminates using HDPE to create recyclable packaging solutions for pharmaceuticals and food.

- Silgan Holdings, Inc. specializes in custom-designed rigid HDPE bottles and closures for the healthcare, automotive, and personal care markets.

- DS Smith utilizes HDPE for reinforcement components and plastic fittings within their large-scale industrial corrugated bulk packaging.

- Uflex Ltd. manufactures HDPE-based multi-layered flexible laminates and woven bags for high-strength moisture protection in bulk commodity packaging.

Tier 2:

- Novolex Holdings

- LLC

- Amcor Plc

- Berry Global Group, Inc.

- Graham Packaging Company

- Alpla Group

- Greif, Inc.

- Sigma Plastics Group

Segment Covered in the Report

By Product Type

- Bottles

- Beverage bottles

- Dairy bottles

- Pharmaceutical bottles

- Personal care bottles

- Containers

- Rigid food containers

- Chemical containers

- Industrial storage containers

- Bags & Sacks

- Industrial liners

- Agricultural sacks

- Heavy-duty transport bags

- Films

- Stretch films

- Shrink films

- Barrier films

- Packaging films

- Others

- Caps & closures

- Crates & pallets

- Drums & barrels

By End-Use Industry

- Food & Beverage

- Bottled beverages

- Dairy & liquid foods

- Frozen & processed food packaging

- Personal Care & Cosmetics

- Shampoo & conditioner bottles

- Lotion & cream containers

- Hygiene product packaging

- Pharmaceuticals

- Medicine bottles

- Medical containers

- Pharmaceutical bulk packaging

- Chemical

- Industrial chemical packaging

- Agrochemical containers

- Specialty chemical packaging

- Industrial

- Lubricant packaging

- Construction material containers

- Logistics & bulk handling

- Others

- Household products

- Consumer goods

- Automotive fluids packaging

By Material

- Virgin HDPE

- Food-grade virgin HDPE

- Industrial-grade virgin HDPE

- Recycled HDPE

- Post-consumer recycled (PCR) HDPE

- Post-industrial recycled (PIR) HDPE

By Technology

- Blow Molding

- Extrusion blow molding

- Injection blow molding

- Stretch blow molding

- Injection Molding

- Thin-wall injection molding

- Precision injection molding

- Others

- Compression molding

- Rotational molding

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5941

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)